The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

Table of ContentsThings about Mileagewise - Reconstructing Mileage LogsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsWhat Does Mileagewise - Reconstructing Mileage Logs Do?Getting The Mileagewise - Reconstructing Mileage Logs To WorkThe Buzz on Mileagewise - Reconstructing Mileage LogsIndicators on Mileagewise - Reconstructing Mileage Logs You Need To KnowMileagewise - Reconstructing Mileage Logs - The Facts

Timeero's Shortest Distance function recommends the shortest driving course to your workers' location. This attribute enhances efficiency and adds to cost savings, making it a crucial possession for services with a mobile workforce.Such a technique to reporting and conformity streamlines the often complex job of managing mileage expenses. There are numerous benefits connected with using Timeero to keep track of gas mileage.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

These extra verification actions will certainly keep the IRS from having a reason to object your gas mileage records. With accurate mileage monitoring innovation, your employees don't have to make rough gas mileage estimates or also fret about gas mileage cost tracking.

For example, if an employee drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all auto expenditures. You will need to proceed tracking mileage for job also if you're making use of the actual expenditure technique. Maintaining mileage records is the only method to separate service and individual miles and supply the proof to the IRS

A lot of mileage trackers allow you log your trips manually while calculating the range and reimbursement quantities for you. Several likewise featured real-time trip monitoring - you need to start the app at the start of your journey and stop it when you reach your final location. These apps log your begin and end addresses, and time stamps, in addition to the total distance and repayment amount.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

One of the concerns that The INTERNAL REVENUE SERVICE states that vehicle expenditures can be thought about as an "ordinary and required" cost throughout operating. This includes prices such as fuel, maintenance, insurance coverage, and the lorry's depreciation. For these prices to be considered insurance deductible, the car needs to be used for organization functions.

The Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

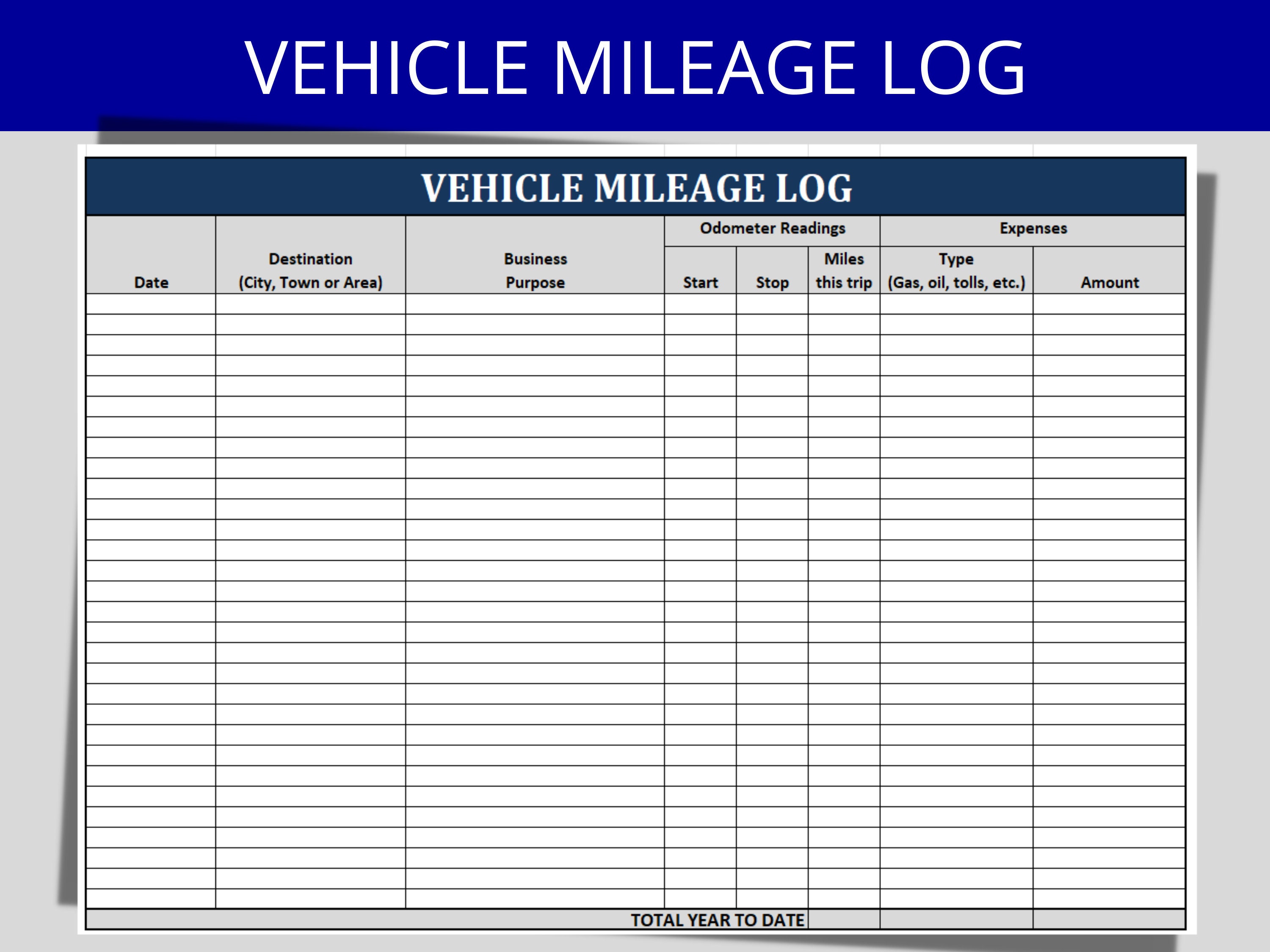

Begin by recording your auto's odometer reading on January 1st and then once more at the end of the year. In between, carefully track all your service journeys writing the beginning and finishing analyses. For every trip, document the area and service function. This can be simplified by maintaining a driving visit your vehicle.

This consists of the overall organization mileage and complete mileage accumulation for the year (service + individual), trip's date, location, and function. It's important to videotape activities without delay and preserve a coexisting driving log detailing day, miles driven, and service purpose. Here's exactly how you can boost record-keeping for audit objectives: Beginning with making sure a thorough gas mileage log for all business-related travel.

Excitement About Mileagewise - Reconstructing Mileage Logs

The real expenditures method is an alternate to the basic mileage price approach. As opposed to computing your reduction based upon a predetermined price simple mileage log per mile, the real expenses method enables you to subtract the actual expenses related to using your lorry for service functions - best mileage tracker app. These expenses include fuel, upkeep, repairs, insurance policy, depreciation, and other related expenditures

Those with substantial vehicle-related costs or one-of-a-kind problems may benefit from the actual costs approach. Inevitably, your picked technique needs to align with your particular financial objectives and tax situation.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Keeping an eye on your gas mileage manually can call for diligence, however bear in mind, it can conserve you cash on your taxes. Adhere to these actions: Create down the day of each drive. Record the total mileage driven. Think about noting your odometer analyses prior to and after each journey. Write down the beginning and finishing points for your trip.

The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

In the 1980s, the airline company market ended up being the initial industrial users of GPS. By the 2000s, the shipping market had embraced GPS to track bundles. And now nearly everybody makes use of GPS to get around. That indicates almost every person can be tracked as they deal with their service. And there's snag.

Comments on “The Only Guide for Mileagewise - Reconstructing Mileage Logs”